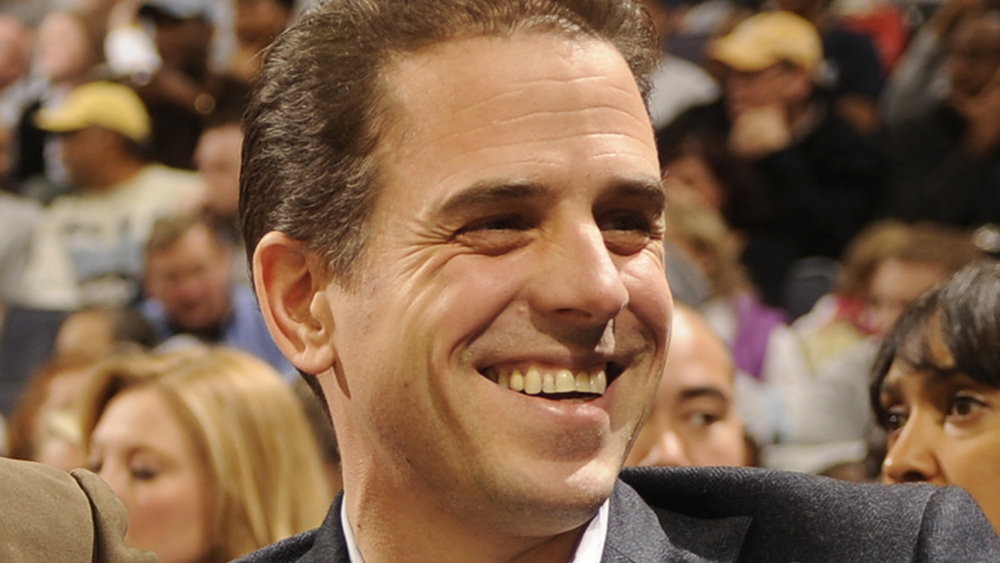

Hunter Biden pleads NOT GUILTY to tax fraud charges in California

01/15/2024 / By Arsenio Toledo

Presidential son Hunter Biden pleaded not guilty to tax fraud charges on Jan. 11 in a federal court in Los Angeles.

Federal prosecutors have accused President Joe Biden’s son of being engaged in a “four-year scheme” to avoid paying at least $1.4 million in federal taxes he owed between 2016 and 2019 to the Internal Revenue Service (IRS). During the same period, Hunter allegedly spent millions of dollars to fund an extravagant lifestyle, purchasing luxury goods and services like drugs, prostitutes and exotic cars.

In December, the U.S District Court for the Central District of California charged Hunter with nine counts of tax crimes, including three felony and six misdemeanor charges related to allegations that he failed to file and pay taxes, evaded tax assessments and filed a false or fraudulent tax return. If convicted, he could face a maximum of 17 years in prison. (Related: Hunter Biden INDICTED on 9 tax charges, could spend up to 17 years in prison.)

Hunter entered a not guilty plea before District Judge Mark Scarsi during the hearing, which combined the presidential son’s initial court appearance with an arraignment and a status conference.

Hunter’s trial is set to begin on June 20, with pre-trial motions to begin on March 27, followed by a pre-trial hearing on June 3. Hunter has been released on his recognizance on conditions, including temporarily forbidding him from possessing firearms and consuming alcohol, marijuana or illegal drugs. He will also be under the direct supervision of pre-trial services.

On the day of the hearing in LA, Hunter did not address news crews or protesters waiting outside the courthouse. But his lawyer Abbe Lowell did make a brief statement stressing that his client has paid his back taxes and is being persecuted only because of his relation to the president.

Hunter made more than $7 million in gross income that he didn’t pay taxes for

In the 56-page indictment against Hunter, federal prosecutors allege that from 2016 to 2019, Hunter earned more than $7 million in gross income which he did not pay taxes for. He avoided paying taxes by reclassifying some personal expenditures – such as luxury hotel stays, luxury vehicle rentals and escort services – as business deductions.

The tax evasion and fraud accusation comes after a years-long federal investigation into Hunter’s tax and business dealings. This investigation was expected to wind down over the summer of 2023 following the finalization of a plea deal in which Hunter would have gotten two years’ probation after pleading guilty to misdemeanor tax charges. This plea deal would have also saved Hunter from being prosecuted on a charge of illegally possessing a firearm.

The deal unraveled after a federal judge who was expected to expedite approval of the deal instead began to question it, resulting in both the tax evasion and illegal gun possession charges moving forward.

The gun charge stems from an accusation in Delaware that Hunter lied in October 2018 on a federal form for gun purchasers when he swore he was not using or addicted to illegal drugs. At the time, he was addicted to crack cocaine. He has also pleaded not guilty in this case.

Watch this clip from Fox News discussing Hunter Biden’s demeanor as he pled not guilty to tax charges in Los Angeles.

This video is from the NewsClips channel on Brighteon.com.

More related stories:

Tom Fitton: Congress HAS THE POWER to ARREST Hunter Biden.

California grand jury indicts Hunter Biden with multiple felony tax charges.

Hunter Biden sues IRS whistleblowers for BREACH OF PRIVACY over tax probe.

Sources include:

Submit a correction >>

Tagged Under:

Biden, Biden crime family, big government, California, corruption, crime, criminals, Hunter Biden, Internal Revenue Service, IRS, Joe Biden, Tax Evasion, tax fraud, taxation, Taxes

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

Trump.News is a fact-based public education website published by Trump News Features, LLC.

All content copyright © 2018 by Trump News Features, LLC.

Contact Us with Tips or Corrections

All trademarks, registered trademarks and servicemarks mentioned on this site are the property of their respective owners.